Part 2: Guide to OHV Titling and Registration In Nevada

-- When Purchasing OHV's From Dealerships --

Recently, I published a Guide to OHV Titling in Nevada specific to the scenario of purchasing an OHV from a private party seller, in which I went through the nuances of filling out Nevada and California titles, which forms you need, and red flags to lookout for. It only made sense to follow that post up with a sequel covering what you need to know about titling and registration for OHV's when purchasing (either new or used) from a Nevada dealer and an out-of-state dealer.

Same disclaimers as before: This subject matter applies to Nevada residents only, and it's not legal advice.

Same disclaimers as before: This subject matter applies to Nevada residents only, and it's not legal advice.

Explanation of Nevada Sales Tax

|

The fundamental element that makes a dealership purchase different from a private party purchase in Nevada is that there is no sales owed for private party transactions. However, for dealership purchases the sales tax due on the purchase price is the GREATER of either (i) the applicable sales tax rate of the county in Nevada you reside in OR (ii) the applicable sales tax rate in the county/state the OHV was purchased in. Here is a map of the sales tax rate for various counties in Nevada (as of June 2021) -- meaning that one way or another, you will pay at least the % amount applicable to your residential county on the purchase price.

Lets say, for example, you live in Washoe County but you went out of your way to adopt a brand new baby from a dirtbike nursery up in Oregon. You got your bike for perceptively cheaper, because Oregon is a state which does not charge any sales tax. Now you'd like to get your new investment titled and registered in your name at home in Nevada.... and you'll then learn that you did not get out of paying sales tax after all -- you will actually owe an entire 8.265% of the purchase price to the Nevada Department of Taxation. |

Similar scenario if you live in a Nevada county with a higher tax rate than the Nevada county that you purchased your toy from. If you reside in Washoe County, but made a purchase from a dealership in Carson City which has a slightly cheaper sales tax rate, the dealer will only collect the tax rate applicable to that dealer's county .... and you will owe an additional 0.665% of the purchase price when you go to register/title (i.e., 8.265% - 7.60% = 0.665%).

But if you live in Lyon County with a 7.10% sales tax rate and make a purchase from a dealership in Washoe County with the higher 8.265% applicable tax rate, you will NOT get a refund on the difference between those tax rates. You will pay the Washoe County tax rate (which will be collected by the dealer at the point of sale), end of story. Same scenario applies for any purchase in any jurisdiction in which you pay a higher sales tax rate than the rate of the county you actually reside in.

But if you live in Lyon County with a 7.10% sales tax rate and make a purchase from a dealership in Washoe County with the higher 8.265% applicable tax rate, you will NOT get a refund on the difference between those tax rates. You will pay the Washoe County tax rate (which will be collected by the dealer at the point of sale), end of story. Same scenario applies for any purchase in any jurisdiction in which you pay a higher sales tax rate than the rate of the county you actually reside in.

Why This Is Applicable

The DMV is tasked with enforcing that sales tax is paid in every change of ownership instance resulting from a commercial (non-private party) transaction, and they do this by preventing titling and/or registration if you cannot prove that applicable sales tax (see above) has been paid by the purchaser. The type of proof the DMV will accept for paid sales taxes depends on whether you purchased from a Nevada dealership or from an out-of-state dealership.

Nevada Dealership Purchases

|

If You Paid Cash

If you bought a new OHV outright from a dealership, some dealers will issue you a Manufacturers Certificate of Origin, which you would then need to send to the DMV to convert to a title in your name. And some dealers will do this step for you resulting in the DMV mailing a title in your name to you. ASK YOUR SALESPERSON WHAT THEIR PROCEDURE IS SO YOU KNOW WHAT TO EXPECT.

If you bought a used OHV from a dealership, the dealer will submit the titling documents directly to the DMV, and the DMV will issue a title in your name which will be mailed to you directly. |

If You Financed

Whether you bought new or used, you will not receive any titling documents from the dealership if you need to make payments -- they will instead be sent to your financial institution as the lienholder, who will hold onto it until you pay off the loan. This is protection for the lender so that you cannot legally sell the vehicle (and why anyone buying OHV's 2012 or newer via private party should be wary of a seller without a title!). When the loan is paid off, the lender will mail you a title in your name with their lienholder interest released.

|

In any event, whether you paid cash or financed, you'll be given copies of your purchase contract and the ever-important Off Highway Vehicle Dealer Report of Sale.

Often times, it is common practice for the Nevada dealership to offer to submit the OHV registration paperwork for you simultaneously when you complete your purchase, as they are already taking care of your title. Taking advantage of this will save you the trouble of mailing in the OHV registration application and supporting documents.

But in the event you don't take care of registration at the dealership, you are going to need to use this OHV 001B Registration Application. On this form unique to Nevada dealership purchases, you input the control number from the Off Highway Vehicle Dealer Report of Sale and include a copy of the the Dealer Report of Sale with the registration application.

Often times, it is common practice for the Nevada dealership to offer to submit the OHV registration paperwork for you simultaneously when you complete your purchase, as they are already taking care of your title. Taking advantage of this will save you the trouble of mailing in the OHV registration application and supporting documents.

But in the event you don't take care of registration at the dealership, you are going to need to use this OHV 001B Registration Application. On this form unique to Nevada dealership purchases, you input the control number from the Off Highway Vehicle Dealer Report of Sale and include a copy of the the Dealer Report of Sale with the registration application.

The DMV will review the Dealer Report of Sale to verify that you paid your applicable sales taxes. If you made your purchase in the same county you live in, this is a non-issue for you. In the event you purchased from a county in Nevada with a sales tax rate lower than the county you reside in (which the DMV will check for), then you will need to get and include a SALES TAX CLEARANCE CERTIFICATE -- skip to the instructions for that below.

Because you are purchasing from a Nevada dealership, you will NOT need to get a VIN inspection.

Because you are purchasing from a Nevada dealership, you will NOT need to get a VIN inspection.

I would like to take this opportunity to remind our readers of

the good local Northern Nevada businesses

who support RAD and sell great toys!

the good local Northern Nevada businesses

who support RAD and sell great toys!

Out of State Dealership Purchases

Since I can't be an expert in every other state's dealership procedures, you need to ask the dealer during the transaction process exactly what to expect with how you will receive a Certificate of Title or Manufacturers Certificate of Origin.

For registration, you will be using this OHV 001D Registration Application:

For registration, you will be using this OHV 001D Registration Application:

With this registration application, you are going to need to include two more things:

- A VIN Inspection, which may be completed by any law enforcement officer or a certified OHV dealership/repair shop (remember, the DMV office does NOT do OHV VIN inspections!).

- A Sales Tax Clearance Certificate (read on below).

How To Obtain a Tax Clearance Certificate

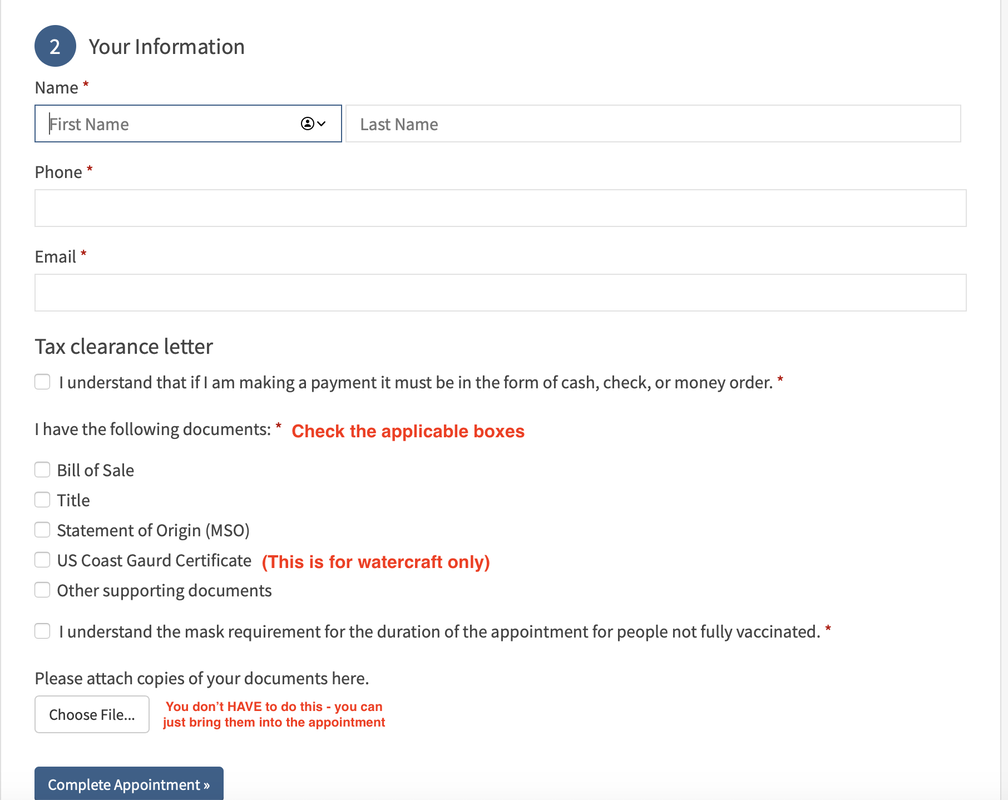

If you have a scenario where you either purchased in-state but owe additional sales tax, or if you made any purchase from an out-of-state dealer regardless of whether you owe sales taxes or not, you will need to get a Tax Clearance Certificate before you can proceed with title and/or registration.

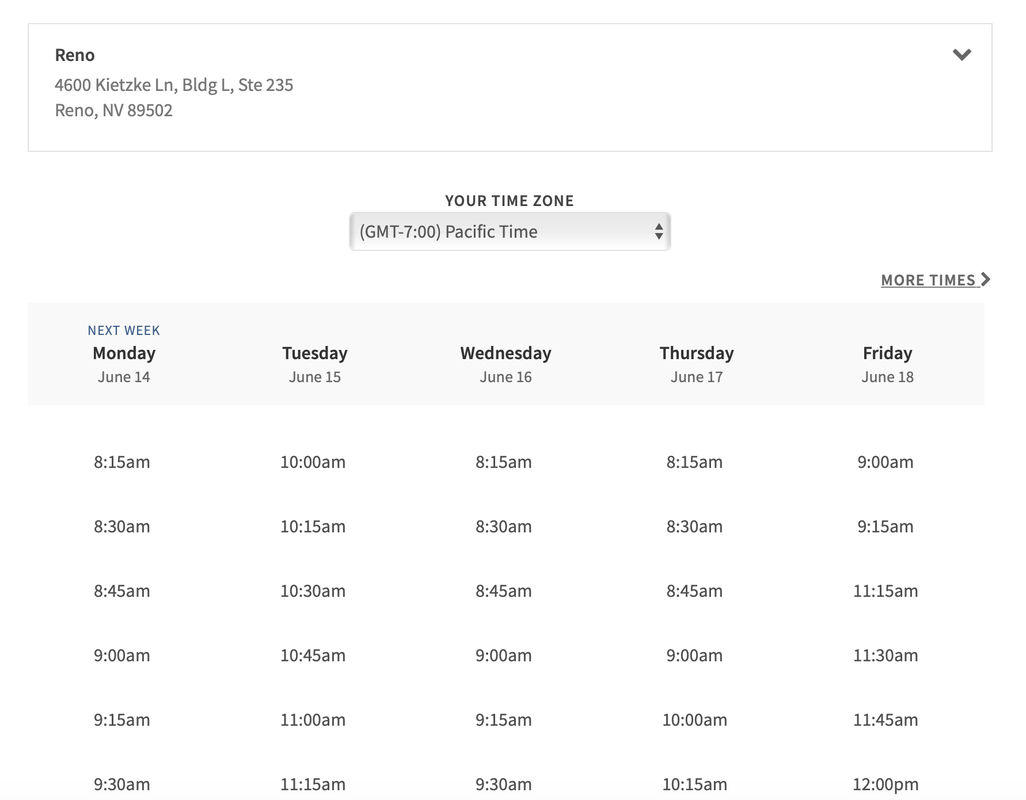

The ONLY WAY you can get this Tax Clearance Certificate is to make an appointment with the Nevada Department of Taxation.

Start here to make an appointment with a local tax office and follow these steps/prompts:

The ONLY WAY you can get this Tax Clearance Certificate is to make an appointment with the Nevada Department of Taxation.

Start here to make an appointment with a local tax office and follow these steps/prompts:

Bring all of your purchase documents with you to your appointment. If you are going to owe sales taxes, be prepared to pay those fees via cash, check or money order -- they do NOT accept credit cards. This is a super quick 15 minute appointment, and you will walk out with the Tax Clearance Certificate that you need to proceed with registration.

Everything You Need

At the end of the day, here is all the paperwork you need for titling and registering OHV's after a dealership purchase:

|

Nevada Dealer Purchase

(Paid Cash) If the dealer didn't handle registration for you:

|

Nevada Dealer Purchase

(Financed) If the dealer didn't handle registration for you:

|

Out-of-State Dealer Purchase

(Paid Cash)

|

Out-of-State Dealer Purchase

(Financed)

|

DMV Fees can be paid by check, money order or by using this credit card form. If you are paying via check or money order, (1) make it payable to Nevada DMV and (2) write separate checks for the registration ($20 each) and titling fees ($28.25 each)(if applicable), since these are processed separately.

After you make copies of everything, mail your whole packet (I recommend sending certified if you are enclosing original titling documents) to:

Nevada Department of Motor Vehicles

Attn: OHV Section

555 Wright Way

Carson City, NV 89701

I hope this guide is helpful to as many riders in Nevada as possible.

After you make copies of everything, mail your whole packet (I recommend sending certified if you are enclosing original titling documents) to:

Nevada Department of Motor Vehicles

Attn: OHV Section

555 Wright Way

Carson City, NV 89701

I hope this guide is helpful to as many riders in Nevada as possible.